Introduction: China's wire and cable industry faces difficulties in financing, low quality, lack of technology, and high raw material prices. Among them, the price of raw material copper greatly affects the profits of cable companies. In the turmoil of the global economy and the ups and downs of copper prices, wire and cable companies have to rely on copper substitutes, control of copper procurement costs, etc. to ensure profits.

Introduction: China's wire and cable industry faces difficulties in financing, low quality, lack of technology, and high raw material prices. Among them, the price of raw material copper greatly affects the profits of cable companies. In the turmoil of the global economy and the ups and downs of copper prices, wire and cable companies have to rely on copper substitutes, control of copper procurement costs, etc. to ensure profits. Copper alternatives <br> <br> alternative copper products in the downstream industry has been overwhelming, Hailiang Group Wang Ming in the "Chinese copper industry development difficulties" that, the domestic wire and cable industry in 2010 to replace copper is about 19.5 ~22.5 million tons. This year, with the advancement of broadband upgrades and triple play, the trend of "bright-forward copper retreat" has intensified. According to news on March 24, the imbalance of supply and demand of domestic optical fiber and optical cables is gradually improving, and optical fiber manufacturers are quite full of orders. Tian Bosheng, a researcher in the optoelectronics industry, said that the demand for optical fibers in the market has shown a growth trend this year and it is expected that the demand for optical fibers will increase by 10% to 15% over 2011.

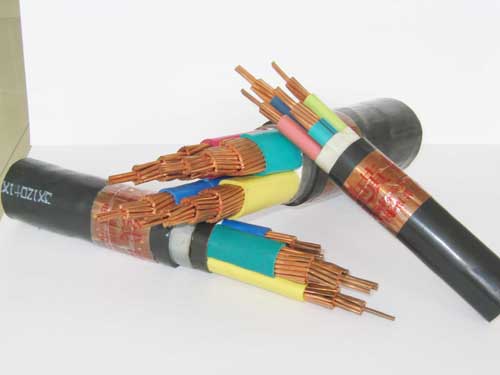

In addition, the use of new energy-saving conductors to improve the efficiency of electrical energy utilization has become a trend in the development of power grids. According to the verification, the current domestic aluminum alloy cable can achieve the same electrical performance as the copper cable, and the cost performance is far better than the latter. On March 12, Shanghai Cable Research Institute held the “Seminar on the Promotion of Application of Aluminum Alloys in Transmission Lines†to promote the application of five kinds of aluminum alloy core conductors in transmission lines, which is bound to trigger an energy-saving aluminum alloy core and related products. R&D and production boom.

Non-ferrous metals network predicts that the power cable output will continue to increase in 2012, and the corresponding power copper will also increase, and the increase is expected to be 8%. However, copper companies are expected to see the most orders for 2012, followed by copper consumption in China after 2011. Again bid farewell to more than 10% rapid growth channel. As the main consumption field of copper products, the suppression of demand for copper products in the wire and cable industry will also affect the development of the copper industry and the trend of copper prices.

With the increasing competition in the market and the open and transparent price information, the profits of cable companies continue to shrink. Only from the point of view of product manufacturing, there are three main links related to product profit: First, reduce the cost of raw material procurement; Second, fine control of the production process; Third, increase sales prices. The possibility and space for high-priced sales are very small. The control of the production process is related to the equipment, technology, talents, and experience of the company and it is not a day's work. Therefore, the control of procurement costs becomes very important.

Generally speaking, the company’s attention to copper prices mainly comes from the London Metal Exchange, the Shanghai Futures Exchange and the Changjiang Spot Price. These prices are all based on the prices of copper cathodes. The materials used by cable companies are copper rods or copper wires. We must also take into account premiums and discounts and processing fees. Copper plate prices and premiums and discounts are changing every day. Processing costs are not the same for copper rod (silk) processing companies. Therefore, the cost of copper control by cable companies is relatively complicated. Most companies practice copper rod processing. The factory signs an annual contract, determines the processing fee standard, and then looks at the futures inventory price every day, or the spot price of the Yangtze River shall prevail. Even so, it cannot ensure that the purchase price of copper is relatively reasonable.

Far East Cable set a precedent for e-commerce in the industry and set up Far East Trading Sourcing Network Technology Co., Ltd.. China Cable Material Exchange used copper rod, copper wire, aluminum rod, plastic and other cable materials as trading products, bringing together a large number of material companies and cables. Enterprises and enterprises directly trade through trading system software, which greatly facilitates the sales of material companies and the purchase of cable companies. Statistics show that in January 2012, the average spot price of copper in the Yangtze River and the previous period was RMB 57,435, the price of 8mm copper rods in the China Cable Material Exchange was only 65 yuan higher than the copper plate price, and the processing fee for copper plates processed into 8mm copper rods was generally 800 yuan. ~1100 yuan, its cost is far lower than the purchase cost of the original purchase method.

DC Power Filter,DC Single Stage Filter,Noise Filter,Dc Motor EMI Filter

Jinan Filtemc Electronic Equipment Co., Ltd. , https://www.chinaemifilter.com